Withdraw When You Want with InstaPay On-Demand

- Pathao Courier

- February 1, 2026

Running a business means juggling deliveries, inventory, and expenses, sometimes all at once. And waiting for payouts when you need cash urgently? Not ideal.

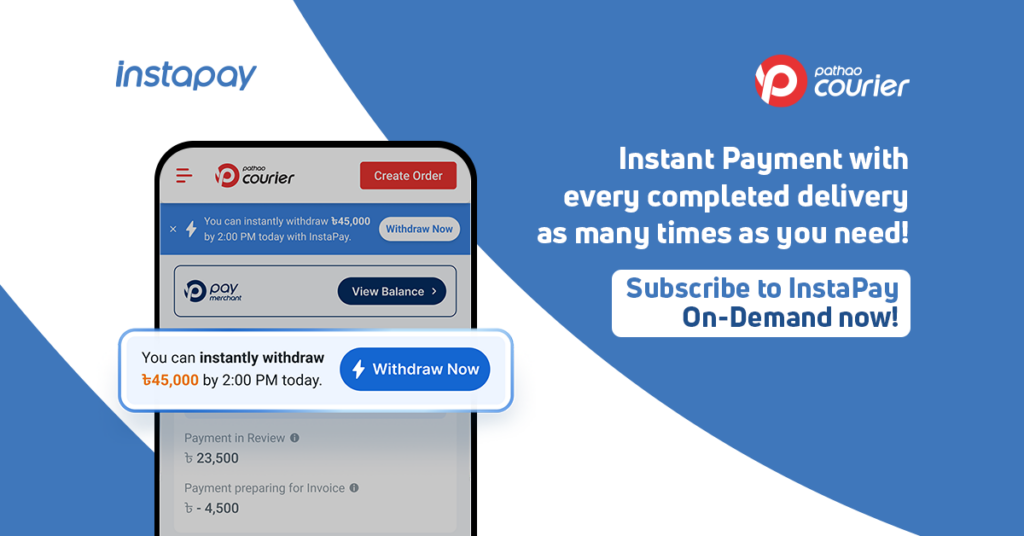

That’s exactly why Pathao brings you InstaPay On-Demand, a flexible withdrawal feature built for courier merchants who want control over when they access their COD money.

No schedules. No waiting. Just withdraw when you actually need it.

What is InstaPay On-Demand?

InstaPay On-Demand allows eligible courier merchants to withdraw their COD earnings anytime, straight into their Pathao Pay Merchant Account.

The best part?

You don’t need to enable regular InstaPay to use it.

You can continue using your usual payout method, and whenever you need quick access to cash, simply make an instant transfer using On-Demand.

Feature availability is subject to eligibility criteria, system availability, and applicable internal policies.

How is On-Demand Different from Regular InstaPay?

Here’s a quick breakdown:

Regular InstaPay

- Automatic daily payouts

- Runs in 3 fixed cycles

- No manual control

InstaPay On-Demand

- Manual withdrawal, only when you need it

- No daily schedule

- Full control over timing

One thing to note:

If you turn on Regular InstaPay, the InstaPay On-demand feature will be disabled.

Who Can Use InstaPay On-Demand?

On-Demand is currently available only to merchants included in the eligible On-Demand list.

If you’re eligible, you’ll see the On-Demand withdrawal option directly in your Courier Merchant Portal.

Eligibility is determined by Pathao and may be updated, modified, or withdrawn at any time.

Where Do I Find the On-Demand Option?

Once available, a dedicated withdrawal section will appear on your Courier Merchant Portal dashboard.

There, you’ll be able to see your total withdrawable balance at a glance.

What Balance Can I Withdraw?

Your withdrawable balance includes:

- All delivered but unpaid COD orders

- Orders appear 1 hour after being marked as delivered (not real-time)

This ensures accuracy while still keeping things fast.

Can I Withdraw a Partial Amount?

No.

When you use On-Demand, you must withdraw the full available amount shown in your dashboard.

Is There Any Fee?

Yes, but only when you actually use it.

- Instant Withdrawal Fee: 2%

- No fee if you don’t make a withdrawal

Simple and transparent.

Fees are subject to change with prior notice.

How Fast Is the Disbursement?

Once you confirm the withdrawal and complete OTP verification, the money is transferred instantly to your Pathao Pay Merchant App.

No delays. No waiting around.

Can I Switch Back to Regular InstaPay?

Yes, you can.

However, if you select regular InstaPay again as your default payment method, InstaPay On-Demand will be automatically disabled.

What If I’m Removed from the On-Demand List?

If you’re no longer on the eligible list:

- The On-Demand option will disappear from your portal

- This applies even if another payment method is selected as default

Is InstaPay On-Demand Always Available?

There is a daily scheduled Locked Period from 11:00 AM to 4:00 PM.

During this window:

- On-Demand withdrawals will be temporarily unavailable

- You can still sign up for InstaPay and receive money on the same day

Locked periods and availability windows may change due to operational or regulatory requirements.

Do I Need a Pathao Pay Merchant Account?

Yes.

You must have a Pathao Pay Merchant Account to withdraw using On-Demand.

If your account isn’t linked yet, the system will prompt you to connect one before proceeding.

When Should You Use InstaPay On-Demand?

InstaPay On-Demand is perfect for moments when cash can’t wait, like:

- Weekend or holiday expenses

- Purchasing inventory

- Business emergencies

- Temporary cash flow gaps

Basically, whenever your business needs money now, not later.

Need Help?

We’re here for you.

- Merchant Hotline: +8809610003036

- Email: [email protected]

InstaPay On-Demand gives you freedom, flexibility, and faster access to what’s already yours.

Because when business moves fast, your money should too.